Employee Equity 101

19 likes6,792 views

The document discusses various aspects of employee equity at startups, including: - How startups raise money from venture capital firms by selling shares of the company - The different classes of shares (common, preferred) that founders, employees and investors hold - The use of option pools to grant stock options to employees as part of their compensation - Factors to consider when evaluating a startup job offer, such as vesting schedules and how much equity the employee would own - How employee equity is affected by future funding rounds and exit events like acquisitions or IPOs

1 of 60

Downloaded 157 times

Ad

Recommended

Stock Options: An Introduction

Stock Options: An Introductionalexlod Stock options allow employees to purchase company stock at a discounted price. There are different types of stock options with varying tax implications. When exercising options and selling shares, it is important to consider variables like vesting schedules, fair market value, capital gains tax rates and alternative minimum tax to maximize profits and minimize taxes. Consulting a tax specialist is recommended to understand individual tax situations related to stock options.

Cap Tables

Cap TablesJohn Richards This document discusses capitalization tables, which outline company ownership and financing. It notes that capitalization tables show who owns what percentage of a company and how much they invested. The document stresses the importance of determining ownership structure and creating detailed long-term financial projections to understand capital needs. It outlines common rounds of financing like founders', accelerators, friends and family, angels, and VC rounds, and how they allocate ownership percentages.

Stock options & early exercise 101

Stock options & early exercise 101Lever Inc. This document provides information about stock options and early exercise. It begins with a disclaimer that the information provided is not financial advice. It then provides definitions of stock options, vesting schedules, and exercise price. It explains that shares are not owned until options are both vested and exercised. The document discusses what early exercise entails, including filing an 83(b) election form and designating gains as long-term capital gains to receive tax benefits. It outlines the pros and cons of early exercise. Finally, it provides step-by-step instructions for employees who want to early exercise their options.

CDL 7 DOUBLES AND TRIPPLES.pptx

CDL 7 DOUBLES AND TRIPPLES.pptxJimsonOgbejele This document provides instructions for coupling, uncoupling, and inspecting double and triple trailers. It discusses the crack-the-whip effect of these combinations and how to safely manage their space. Specific steps are outlined for coupling and uncoupling twin trailers, including positioning converter dollies and connecting air and electrical lines. Additional inspection checks are recommended when operating doubles and triples, such as ensuring air flows to all trailers. Proper functioning of trailer brakes and the tractor protection valve are also tested.

Issuing Equity to Employees and Founders: Stock Options and Restricted Stock

Issuing Equity to Employees and Founders: Stock Options and Restricted StockDavid Ehrenberg Before issuing equity to employees, you need to be aware of the potential consequences. Sure equity is a tool to hire top talent, but how much equity you give — and to whom — is not a decision to be entered into lightly.

For information about issuing equity — and help slicing up the equity pie — check out this deck from Annie Webber from Legal Hero (www.legalhero.com) and David Ehrenberg from Early Growth Financial Services (www.earlygrowthfinancialservices.com).

Equity Compensation Design and Use Matrix: stock options, restricted stock, e...

Equity Compensation Design and Use Matrix: stock options, restricted stock, e...PERFORMENSATION This document provides a summary of various types of equity compensation plans, including their primary uses, typical plan sponsors and recipients, main features, and key accounting, legal, tax, communication, and administration issues. It summarizes 14 major types of equity plans: incentive stock options, non-qualified stock options, restricted stock shares, restricted stock units, performance awards, stock appreciation rights, employee stock purchase plans, non-qualified stock purchase plans, deferred stock units, phantom stock awards, and their purposes in attracting, motivating, and retaining employees while addressing the complex tax, accounting and legal issues associated with each.

Employee Stock Options 101

Employee Stock Options 101Wattpad Our technology and the power of the crowd will publish, review, curate and distribute a continual flow of relevant, quality content for everyone. This document discusses stock options that are commonly offered to employees at startups as a form of equity compensation. Stock options give employees the right to purchase company stock at a fixed price for a specified period of time. The value of stock options depends on how much the current market price of the stock exceeds the grant price. Key aspects covered include vesting schedules, exercising options, and potential tax advantages of stock options for Canadian employees.

Mines act-1952 over view

Mines act-1952 over viewibalakumar The document provides definitions and outlines provisions around health, safety, employment conditions and leave for workers in mines according to the Mines Act of 1952 in India. Key points include defining terms like mine, mineral, owner and employee; requiring notice before starting mining operations; mandating qualifications and responsibilities for mine managers; provisions around drinking water, sanitation, medical facilities, accidents, diseases; regulating work hours and leave; and empowering inspectors to enforce the Act.

Pitching for Fundraising - SVA

Pitching for Fundraising - SVATaylor Davidson This document provides advice on pitching and fundraising. It discusses the key elements to include in a pitch like problem, solution, team, market and traction. It emphasizes hooking the audience from the start and controlling the story. Different audiences like VCs, crowdfunders and foundations require tailored pitches. Relationship building and understanding what investors need is important. The document also addresses common gaps, materials to provide, and tips for finding the right partners and learning from rejections.

Fundraising for Entrepreneurs

Fundraising for EntrepreneursTaylor Davidson Slides from a talk about fundraising for entrepreneurs at Tepper School of Business at Carnegie Mellon University, Feb 14, 2014

Wealthfront Equity Plan

Wealthfront Equity PlanWealthfront The document provides a detailed recipe for implementing the Wealthfront Equity Plan to attract and retain employees. It outlines granting equity for new hires, promotions, top performers, and evergreen grants to existing employees. For new hires, it determines market rates and calculates an "equity budget" totaling 1.92% dilution. Promotions are granted the difference to the market rate. Top performers receive 50% of current market rates, totaling 0.5% dilution. Evergreen grants of 25% of market rates each year total 1.4% dilution. The total dilution of 3.945% is within an acceptable range of 3-5%.

Examples of Company Core Values

Examples of Company Core ValuesLeading Resources, Inc. You need to listen carefully for clues that your organization has failed to engage in a deep examination of the company’s core values. If you sense this, or inherit a listless organization, resolve to do something about it right away. Nothing is more important if you want to build a leadership culture.

Everyone can be a Professional Photographer (SXSW 2010)

Everyone can be a Professional Photographer (SXSW 2010)Taylor Davidson Taylor Davidson will give a talk titled "Anybody Can Be a Photographer" at SXSW in Austin, TX on March 14th. The talk will discuss what defines a "professional" photographer and whether photography needs to be one's sole source of income. Davidson will also address how technology has made it both easier and harder to be a professional photographer today. Additional topics will include the ethical pitfalls of being a part-time photographer, copyright and ownership issues, starting to sell photographs, and how to use online marketing and photography in other business ventures and careers.

Be On Point: How to stop doing things that don't matter

Be On Point: How to stop doing things that don't matterTaylor Davidson Be on Point: How to stop doing things that don't matter. Lessons learned from a year of spending a lot of time chasing split ends and fracturing priorities.

IgniteNOLA, Feb 1, 2010

Boston startup scene fall 2016 (final)

Boston startup scene fall 2016 (final)Jeffrey Bussgang This presentation discusses what makes Boston's startup scene special, including its intellectual capital from top universities like MIT and Harvard, its venture capital funding, and successful companies. It notes the dense concentration of innovation in Boston's tech sector and life sciences industry, as well as the many resources that support startups like accelerators, investors, and entrepreneurial leaders. The conclusion is that Boston is a top ranked city for innovation.

Equity Compensation - Comparison of Plan Types: Including Stock Options, RSUs...

Equity Compensation - Comparison of Plan Types: Including Stock Options, RSUs...PERFORMENSATION This presentation will bring clarity to common complications and conflicts in equity compensation, including the basics of acronyms, tax rules, differences between core practice rules and regulations, benefits to employee and more.

Learn how to translate equity-specific acronyms and terms into plain English

Learn how participants make money from Appreciation Only, Full Value and Stock Purchase plans and how each can be a great or poor solution.

Learn the pros, cons and differences between commonly used equity compensation instruments. You will be surprised how similar and different they can be!

Raising Seed Capital

Raising Seed CapitalSteve Schlafman This document provides guidance on raising seed capital from venture capital firms and other investors. It discusses the basics of venture capital and seed stage funding. Key points include:

- Seed funding ranges from $50k-$1.5M and is used to build an initial product and validate the business idea. It discusses various sources of seed capital including angels, accelerators, seed funds, and some VCs.

- Preparing for a fundraise involves launching a minimum viable product to prove traction, finding experienced advisors, crafting an investor pitch deck, and networking within the startup community.

- When pitching investors, the goals are to excite them about the opportunity and make them fear missing out. The pitch should

How to raise your first round of capital - February 2017

How to raise your first round of capital - February 2017Jeffrey Bussgang The document provides guidance on raising a first round of capital from venture capitalists (VCs). It discusses why entrepreneurs may want to raise money from VCs, including their deep pockets, appetite for transformative ideas, experience advising companies, and industry connections. The document outlines key aspects of pitching to VCs, including highlighting the problem, solution, market opportunity, competitive advantages, go-to-market strategy, and financial projections. It emphasizes the importance of a strong introduction, addressing investor criteria like a large market and unfair advantage, and being prepared for diligence questions after the pitch. The document concludes with discussing term sheets, expectations setting, and determining when a company is ready to fundraise.

CFO Summit San Carlos, CA July 2015

CFO Summit San Carlos, CA July 2015Zuora, Inc. This will truly be an intimate forum to discuss market trends, metrics and benchmarks that resulted from the CFO Metrics Survey launched earlier this year.

How to Break Through No Man's Land - The Stage Where Growing Companies Get Stuck

How to Break Through No Man's Land - The Stage Where Growing Companies Get Stucknewportboardgroup Catherine Cates presented on how growing companies get stuck in "No Man's Land" between being a small startup and large established business. In this stage, companies often see stalled growth and profits. She outlined four key areas ("M's") to focus on: 1) refining the marketing strategy and value proposition; 2) creating an economic model that can scale profitably; 3) raising capital to finance growth; and 4) professionalizing management while maintaining culture. Tools like the Inc. Navigator can help assess alignment and priorities across the leadership team. Breaking through No Man's Land requires balancing entrepreneurial vision with business maturity.

Decision Analysis in Venture Capital workshop for Stanford Angels and Entrepr...

Decision Analysis in Venture Capital workshop for Stanford Angels and Entrepr...Ulu Ventures This is a workshop given for Stanford Angels and Entrepreneurs India on Jul 10, 2018 at Nexus Venture Partners, Bangalore. The video for this talk is at: https://vimeo.com/279467353

The State of WordPress Business

The State of WordPress BusinessBrian Krogsgard This document discusses the state of the WordPress business ecosystem. It provides statistics on WordPress professionals, including that tens of thousands consider themselves self-learners and that most salaries are reported as being a little low. It also outlines the types of WordPress businesses like consulting, themes/plugins, SaaS, and how their models evolve. Key opportunities and threats to WordPress are noted as well as popular plugins and website development costs.

why standard valuation matrix is not the best way to value great businesses

why standard valuation matrix is not the best way to value great businessesperfectresearch The presentation is an attempt to collate thoughts on the investment process we follow from the Gurus, Mentors and Friends we follow along with our own experience in this field.

*Disclaimer*

1. We are not SEBI registered analysts

2. Educational post only and not a stock recommendation

3. We take no responsibility to keep updating about the business being discussed

4. We may or may not own a position in any of the businesses being discussed and even if we do own a position, we may change our mind due to change in any facts or circumstances

5. Plz consider this post only as a framework to keep tracking businesses and understanding them

200 Startups Who Raised $360

200 Startups Who Raised $360Evett Shulman The document summarizes key findings from research analyzing the fundraising processes of 200 startup companies that raised over $360 million. Some of the main findings include:

- The average successful seed round raised $1.3 million over 12.5 weeks contacting 58 investors and having 40 investor meetings. Pitch decks averaged 19 pages.

- Seed rounds that raised funds from venture capital firms rather than angels raised more money ($1.99M vs $989k) in less time (9.6 weeks vs 36.8 weeks) contacting fewer investors.

- Consumer, business, marketplace and hardware startups had the most fundraising success, with marketplace startups raising the highest average amount.

Docsend fundraising research

Docsend fundraising researchAravind (Avi) Bharadwaj The document summarizes key findings from research conducted by DocSend and Harvard Business School on the fundraising processes of 200 startup companies. Some of the main findings include:

- The average successful seed round raised $1.3 million over 12.5 weeks from contacting 58 investors and having 40 investor meetings. Pitch decks averaged 19 pages.

- Investors spent an average of 3 minutes and 44 seconds viewing each pitch deck, with the most time spent on financials pages despite many decks not including financials.

- Companies should focus on quality over quantity of investors contacted. While more meetings can be obtained by contacting more investors, this did not correlate with raising more money.

- Raising from a

DocSend fundraising research 2015

DocSend fundraising research 2015Dmitry Tseitlin The document summarizes key findings from research analyzing the fundraising processes of 200 startup companies that raised over $360 million. Some of the main findings include:

- The average successful seed round raised $1.3 million over 12.5 weeks contacting 58 investors and having 40 investor meetings. Pitch decks averaged 19 pages.

- Later stage Series A rounds raised more money ($8 million on average) contacting fewer investors over less time (9.6 weeks on average).

- Investors spent the most time reviewing financials and team slides, so companies should focus effort there.

- It's better to focus on quality introductions to 20-30 investors who fit, rather than contacting hundreds. Seed funding

DocSend Fundraising Research: What we Learned from 200 Startups Who Raised $360M

DocSend Fundraising Research: What we Learned from 200 Startups Who Raised $360MDocSend Why do some startups get funded? What makes for the best pitch? How does the process work?

DocSend recently teamed up with Professor Tom Eisenmann from Harvard Business School. Together, we conducted research that gave us the answers to those questions. We studied the fundraising of 200 startup companies as they went through their Series Seed and Series A rounds. Altogether, these companies raised more than $360 million.

Why this data is awesome:

Fundraising is a historically opaque endeavor. There’s very little data available and most advice tends to be anecdotal. DocSend is in the unique position of being able to quantitatively analyze the interaction between founders and investors, and tie that to fundraising outcomes in a statistically meaningful way.

Why we built this report:

DocSend aims to help companies share documents in a smarter, safer, and more impactful way. We believe this research is in service of that mission and can help push the startup ecosystem forward as a whole.

Background on DocSend:

DocSend helps sales people track and control documents they send to clients. We’ve also become very popular amongst founders in the fundraising process. Hundreds of startups have used our platform to circulate pitch decks to investors.

Ready to ditch email attachments and put your pitch materials to work for you?

Sign up for a free plan at docsend.com

ASTAA Sales vs Finance 10-11-17

ASTAA Sales vs Finance 10-11-17Marilyn Landis This document provides an overview of how bringing together sales and finance can help a business succeed. It discusses how finance can provide the return on investment for sales tools and teams. Key financial metrics like profit margins, fixed vs variable expenses, and how costs are allocated are examined. The importance of understanding which customers and accounts are most profitable is emphasized. Real-world examples of business metrics and profit margins by industry and company size are presented. The overall message is that an integrated approach to sales and finance can help businesses make better investment decisions and ensure sustainability.

VC Funding for Geeks; or, How to Get Your Technology to Emerge the VC Way

VC Funding for Geeks; or, How to Get Your Technology to Emerge the VC Waycoolstuff This was an etech talk by Marc Hedlund, Chief Product Officer, Wesabe

Geeks and venture capitalists often don't speak the same language. This talk provides a look at venture capital financing from the point of view of the technologist. If you have an idea for a technology company or a technology you'd like to make into a product, should you look for VC backing? What should your expectations be going into the process? What are some of the common pitfalls technologists encounter when they try to find VC funding? How can you talk about your technology and your company in a way that will appeal to potential venture backers?

We'll approach the topic of venture backing without getting bogged down in the finance terminology common to VC primers (though references for those topics will be provided). You'll be given a more informal set of advice; rules of thumb and cautions will predominate.

Keynote- Amit Anand, Jungle Ventures at IBM StartupXchange Singapore

Keynote- Amit Anand, Jungle Ventures at IBM StartupXchange SingaporeJungle Ventures There is a growing gap between companies that get seed funding and those that are able to secure Series A funding. How do startups increase their chances of crossing this chasm?

Here are top 5 learnings from our portfolio as shared at IBM StartupXchange in Singapore.

Ad

More Related Content

Viewers also liked (10)

Pitching for Fundraising - SVA

Pitching for Fundraising - SVATaylor Davidson This document provides advice on pitching and fundraising. It discusses the key elements to include in a pitch like problem, solution, team, market and traction. It emphasizes hooking the audience from the start and controlling the story. Different audiences like VCs, crowdfunders and foundations require tailored pitches. Relationship building and understanding what investors need is important. The document also addresses common gaps, materials to provide, and tips for finding the right partners and learning from rejections.

Fundraising for Entrepreneurs

Fundraising for EntrepreneursTaylor Davidson Slides from a talk about fundraising for entrepreneurs at Tepper School of Business at Carnegie Mellon University, Feb 14, 2014

Wealthfront Equity Plan

Wealthfront Equity PlanWealthfront The document provides a detailed recipe for implementing the Wealthfront Equity Plan to attract and retain employees. It outlines granting equity for new hires, promotions, top performers, and evergreen grants to existing employees. For new hires, it determines market rates and calculates an "equity budget" totaling 1.92% dilution. Promotions are granted the difference to the market rate. Top performers receive 50% of current market rates, totaling 0.5% dilution. Evergreen grants of 25% of market rates each year total 1.4% dilution. The total dilution of 3.945% is within an acceptable range of 3-5%.

Examples of Company Core Values

Examples of Company Core ValuesLeading Resources, Inc. You need to listen carefully for clues that your organization has failed to engage in a deep examination of the company’s core values. If you sense this, or inherit a listless organization, resolve to do something about it right away. Nothing is more important if you want to build a leadership culture.

Everyone can be a Professional Photographer (SXSW 2010)

Everyone can be a Professional Photographer (SXSW 2010)Taylor Davidson Taylor Davidson will give a talk titled "Anybody Can Be a Photographer" at SXSW in Austin, TX on March 14th. The talk will discuss what defines a "professional" photographer and whether photography needs to be one's sole source of income. Davidson will also address how technology has made it both easier and harder to be a professional photographer today. Additional topics will include the ethical pitfalls of being a part-time photographer, copyright and ownership issues, starting to sell photographs, and how to use online marketing and photography in other business ventures and careers.

Be On Point: How to stop doing things that don't matter

Be On Point: How to stop doing things that don't matterTaylor Davidson Be on Point: How to stop doing things that don't matter. Lessons learned from a year of spending a lot of time chasing split ends and fracturing priorities.

IgniteNOLA, Feb 1, 2010

Boston startup scene fall 2016 (final)

Boston startup scene fall 2016 (final)Jeffrey Bussgang This presentation discusses what makes Boston's startup scene special, including its intellectual capital from top universities like MIT and Harvard, its venture capital funding, and successful companies. It notes the dense concentration of innovation in Boston's tech sector and life sciences industry, as well as the many resources that support startups like accelerators, investors, and entrepreneurial leaders. The conclusion is that Boston is a top ranked city for innovation.

Equity Compensation - Comparison of Plan Types: Including Stock Options, RSUs...

Equity Compensation - Comparison of Plan Types: Including Stock Options, RSUs...PERFORMENSATION This presentation will bring clarity to common complications and conflicts in equity compensation, including the basics of acronyms, tax rules, differences between core practice rules and regulations, benefits to employee and more.

Learn how to translate equity-specific acronyms and terms into plain English

Learn how participants make money from Appreciation Only, Full Value and Stock Purchase plans and how each can be a great or poor solution.

Learn the pros, cons and differences between commonly used equity compensation instruments. You will be surprised how similar and different they can be!

Raising Seed Capital

Raising Seed CapitalSteve Schlafman This document provides guidance on raising seed capital from venture capital firms and other investors. It discusses the basics of venture capital and seed stage funding. Key points include:

- Seed funding ranges from $50k-$1.5M and is used to build an initial product and validate the business idea. It discusses various sources of seed capital including angels, accelerators, seed funds, and some VCs.

- Preparing for a fundraise involves launching a minimum viable product to prove traction, finding experienced advisors, crafting an investor pitch deck, and networking within the startup community.

- When pitching investors, the goals are to excite them about the opportunity and make them fear missing out. The pitch should

How to raise your first round of capital - February 2017

How to raise your first round of capital - February 2017Jeffrey Bussgang The document provides guidance on raising a first round of capital from venture capitalists (VCs). It discusses why entrepreneurs may want to raise money from VCs, including their deep pockets, appetite for transformative ideas, experience advising companies, and industry connections. The document outlines key aspects of pitching to VCs, including highlighting the problem, solution, market opportunity, competitive advantages, go-to-market strategy, and financial projections. It emphasizes the importance of a strong introduction, addressing investor criteria like a large market and unfair advantage, and being prepared for diligence questions after the pitch. The document concludes with discussing term sheets, expectations setting, and determining when a company is ready to fundraise.

Similar to Employee Equity 101 (20)

CFO Summit San Carlos, CA July 2015

CFO Summit San Carlos, CA July 2015Zuora, Inc. This will truly be an intimate forum to discuss market trends, metrics and benchmarks that resulted from the CFO Metrics Survey launched earlier this year.

How to Break Through No Man's Land - The Stage Where Growing Companies Get Stuck

How to Break Through No Man's Land - The Stage Where Growing Companies Get Stucknewportboardgroup Catherine Cates presented on how growing companies get stuck in "No Man's Land" between being a small startup and large established business. In this stage, companies often see stalled growth and profits. She outlined four key areas ("M's") to focus on: 1) refining the marketing strategy and value proposition; 2) creating an economic model that can scale profitably; 3) raising capital to finance growth; and 4) professionalizing management while maintaining culture. Tools like the Inc. Navigator can help assess alignment and priorities across the leadership team. Breaking through No Man's Land requires balancing entrepreneurial vision with business maturity.

Decision Analysis in Venture Capital workshop for Stanford Angels and Entrepr...

Decision Analysis in Venture Capital workshop for Stanford Angels and Entrepr...Ulu Ventures This is a workshop given for Stanford Angels and Entrepreneurs India on Jul 10, 2018 at Nexus Venture Partners, Bangalore. The video for this talk is at: https://vimeo.com/279467353

The State of WordPress Business

The State of WordPress BusinessBrian Krogsgard This document discusses the state of the WordPress business ecosystem. It provides statistics on WordPress professionals, including that tens of thousands consider themselves self-learners and that most salaries are reported as being a little low. It also outlines the types of WordPress businesses like consulting, themes/plugins, SaaS, and how their models evolve. Key opportunities and threats to WordPress are noted as well as popular plugins and website development costs.

why standard valuation matrix is not the best way to value great businesses

why standard valuation matrix is not the best way to value great businessesperfectresearch The presentation is an attempt to collate thoughts on the investment process we follow from the Gurus, Mentors and Friends we follow along with our own experience in this field.

*Disclaimer*

1. We are not SEBI registered analysts

2. Educational post only and not a stock recommendation

3. We take no responsibility to keep updating about the business being discussed

4. We may or may not own a position in any of the businesses being discussed and even if we do own a position, we may change our mind due to change in any facts or circumstances

5. Plz consider this post only as a framework to keep tracking businesses and understanding them

200 Startups Who Raised $360

200 Startups Who Raised $360Evett Shulman The document summarizes key findings from research analyzing the fundraising processes of 200 startup companies that raised over $360 million. Some of the main findings include:

- The average successful seed round raised $1.3 million over 12.5 weeks contacting 58 investors and having 40 investor meetings. Pitch decks averaged 19 pages.

- Seed rounds that raised funds from venture capital firms rather than angels raised more money ($1.99M vs $989k) in less time (9.6 weeks vs 36.8 weeks) contacting fewer investors.

- Consumer, business, marketplace and hardware startups had the most fundraising success, with marketplace startups raising the highest average amount.

Docsend fundraising research

Docsend fundraising researchAravind (Avi) Bharadwaj The document summarizes key findings from research conducted by DocSend and Harvard Business School on the fundraising processes of 200 startup companies. Some of the main findings include:

- The average successful seed round raised $1.3 million over 12.5 weeks from contacting 58 investors and having 40 investor meetings. Pitch decks averaged 19 pages.

- Investors spent an average of 3 minutes and 44 seconds viewing each pitch deck, with the most time spent on financials pages despite many decks not including financials.

- Companies should focus on quality over quantity of investors contacted. While more meetings can be obtained by contacting more investors, this did not correlate with raising more money.

- Raising from a

DocSend fundraising research 2015

DocSend fundraising research 2015Dmitry Tseitlin The document summarizes key findings from research analyzing the fundraising processes of 200 startup companies that raised over $360 million. Some of the main findings include:

- The average successful seed round raised $1.3 million over 12.5 weeks contacting 58 investors and having 40 investor meetings. Pitch decks averaged 19 pages.

- Later stage Series A rounds raised more money ($8 million on average) contacting fewer investors over less time (9.6 weeks on average).

- Investors spent the most time reviewing financials and team slides, so companies should focus effort there.

- It's better to focus on quality introductions to 20-30 investors who fit, rather than contacting hundreds. Seed funding

DocSend Fundraising Research: What we Learned from 200 Startups Who Raised $360M

DocSend Fundraising Research: What we Learned from 200 Startups Who Raised $360MDocSend Why do some startups get funded? What makes for the best pitch? How does the process work?

DocSend recently teamed up with Professor Tom Eisenmann from Harvard Business School. Together, we conducted research that gave us the answers to those questions. We studied the fundraising of 200 startup companies as they went through their Series Seed and Series A rounds. Altogether, these companies raised more than $360 million.

Why this data is awesome:

Fundraising is a historically opaque endeavor. There’s very little data available and most advice tends to be anecdotal. DocSend is in the unique position of being able to quantitatively analyze the interaction between founders and investors, and tie that to fundraising outcomes in a statistically meaningful way.

Why we built this report:

DocSend aims to help companies share documents in a smarter, safer, and more impactful way. We believe this research is in service of that mission and can help push the startup ecosystem forward as a whole.

Background on DocSend:

DocSend helps sales people track and control documents they send to clients. We’ve also become very popular amongst founders in the fundraising process. Hundreds of startups have used our platform to circulate pitch decks to investors.

Ready to ditch email attachments and put your pitch materials to work for you?

Sign up for a free plan at docsend.com

ASTAA Sales vs Finance 10-11-17

ASTAA Sales vs Finance 10-11-17Marilyn Landis This document provides an overview of how bringing together sales and finance can help a business succeed. It discusses how finance can provide the return on investment for sales tools and teams. Key financial metrics like profit margins, fixed vs variable expenses, and how costs are allocated are examined. The importance of understanding which customers and accounts are most profitable is emphasized. Real-world examples of business metrics and profit margins by industry and company size are presented. The overall message is that an integrated approach to sales and finance can help businesses make better investment decisions and ensure sustainability.

VC Funding for Geeks; or, How to Get Your Technology to Emerge the VC Way

VC Funding for Geeks; or, How to Get Your Technology to Emerge the VC Waycoolstuff This was an etech talk by Marc Hedlund, Chief Product Officer, Wesabe

Geeks and venture capitalists often don't speak the same language. This talk provides a look at venture capital financing from the point of view of the technologist. If you have an idea for a technology company or a technology you'd like to make into a product, should you look for VC backing? What should your expectations be going into the process? What are some of the common pitfalls technologists encounter when they try to find VC funding? How can you talk about your technology and your company in a way that will appeal to potential venture backers?

We'll approach the topic of venture backing without getting bogged down in the finance terminology common to VC primers (though references for those topics will be provided). You'll be given a more informal set of advice; rules of thumb and cautions will predominate.

Keynote- Amit Anand, Jungle Ventures at IBM StartupXchange Singapore

Keynote- Amit Anand, Jungle Ventures at IBM StartupXchange SingaporeJungle Ventures There is a growing gap between companies that get seed funding and those that are able to secure Series A funding. How do startups increase their chances of crossing this chasm?

Here are top 5 learnings from our portfolio as shared at IBM StartupXchange in Singapore.

Goal Summit 2016: Build a Legacy

Goal Summit 2016: Build a LegacyBetterWorks BetterWorks CEO Kris Duggan kicks of Goal Summit 2016 by diving into the day's theme: Build a Legacy. Find out what it takes to build a lasting legacy for your organization.

Budgeting for Customer Success in 2015

Budgeting for Customer Success in 2015Gainsight The document provides guidance on budgeting for customer success in 2015, including setting goals, determining necessary roles and headcount, and justifying investments. It recommends setting segmented churn and upsell goals based on maturity and focusing initiatives on retention and expansion. Metrics like accounts per CSM and hours per account can help determine optimal headcount. Technologies and services can drive efficiency and effectiveness, and their ROI justified by increased retention, upsell, and advocacy. The webinar offers Gainsight's actual 2015 customer success budget as a starting point.

Startup Valuation: from early to mature stages

Startup Valuation: from early to mature stagesTatiana Siyanko Methods and approached to startup and company valuations.

Please be free to send me any additions/correction proposals.

Prepared for Startup&co lecture in Freud cafe, Kyiv, April 30, 2014

How Investors do Valuations for Startups by Sanjay Mehta from 100x.vc

How Investors do Valuations for Startups by Sanjay Mehta from 100x.vcClientjoy.io Here's the presentation from masterclass with INC 42 by Mr. Sanjay Mehta on how Investors do Valuations for early stage startups.

Here’s The Deck Andy Raskin Called “The Greatest Sales Pitch I’ve Seen All Year”

Here’s The Deck Andy Raskin Called “The Greatest Sales Pitch I’ve Seen All Year”Drift Andy Raskin has led strategic story training at Uber, Intel, Yelp, General Assembly and Stanford and called this the greatest sales pitch he's seen all year. Have a look.

Workable Presentation at TechStartupJobs Fair London 2014

Workable Presentation at TechStartupJobs Fair London 2014TechMeetups Workable helps companies improve the quality and efficiency of their hiring by simplifying the most time-consuming task: browsing, screening and managing candidates. Workable is also sponsor of ‘TechStartupJobs Fair London 2014’.

Funding, equity, valuations by Jordan Schlipf

Funding, equity, valuations by Jordan SchlipfStartupbootcamp Presentation about Fundraising given by Jordan Schlipf (Founder Centric) on Startupbootcamp Alumni Summit 23 & 24 Jan '14 in London.

Design House vs Manufacturing : Entrepreneurship

Design House vs Manufacturing : Entrepreneurship Neha Kumar This document outlines a presentation comparing entrepreneurship in design houses versus manufacturing. It discusses factors to consider for entrepreneurs such as passion, risk-taking ability, and experience. When starting a business, mentors can provide knowledge and experience though may lack funds. Manufacturing provides jobs but requires large funds, while design houses have smaller funds requirements but also smaller profits. The document compares the manufacturing process, team structure, fundraising options, and concludes that manufacturing is needed for India's overall growth, and India must move faster economically to compete globally.

Ad

More from Taylor Davidson (12)

kbs Ventures Fellows

kbs Ventures FellowsTaylor Davidson The document discusses entrepreneurship education and experiences. It lists 12,000+ people taking part in 6 classes across 109 people. It then lists several startup accelerators and incubators such as General Assembly, WeWork, 500 Startups. The document emphasizes passion and diversity in entrepreneurship and mentions outlets outside traditional hierarchies that can enable growth.

The Internet of Things ... is about People (Startup Iceland)

The Internet of Things ... is about People (Startup Iceland)Taylor Davidson Talk about the Internet of Things, at Startup Iceland (http://www.startupiceland.com/) June 2, 2014, in Reykjavik, Iceland.

The State of Programmatic

The State of ProgrammaticTaylor Davidson The document discusses the state of programmatic advertising and outlines several key points:

1. Programmatic advertising has grown significantly in the past 10 years but is still evolving as the pillars that support it, like third-party cookies and mobile usage, are changing.

2. How people consume media is shifting massively to mobile and social platforms, and advertising models must follow users to these new mediums.

3. For programmatic advertising to succeed long-term, ad formats need to fit the medium and provide a good user experience rather than prioritizing short-term monetization. When done well with relevant content, intent targeting, and first-party data, programmatic can be user-centric.

Photography Industry Landscape

Photography Industry LandscapeTaylor Davidson The document outlines various sectors of the photography industry landscape including camera manufacturers, accessories, editing software and services, photographer agencies, stock photography agencies, post-production services, sharing platforms, advertising, ecommerce, infrastructure, applications, professional and consumer photo management, prints and products, corporate photo management, image security, phone manufacturers, photographer discovery services, retailers and rentals, mobile editing, and wearable devices.

2011 kbs+ Ventures Annual Report

2011 kbs+ Ventures Annual ReportTaylor Davidson kbs+p Ventures debuted in Q1 2011 as a differentiated, strategic value-added investor in marketing and advertising technology. They evaluated over 120 potential investments and ultimately invested in 7 early-stage companies focused on adtech and marketing tech. Building the venture arm provided value to portfolio companies through strategic introductions and helped bring innovation to kbs+p clients.

Email Never Died. How to Build a Community through an E-Newsletter.

Email Never Died. How to Build a Community through an E-Newsletter.Taylor Davidson Email Never Died. How to Build a Community through an E-Newsletter. The story of NOLAlicious (http://nolalicious.com), at TribeCon (http://tribecon.com), the community conference, in New Orleans, LA. October 28, 2010.

"The Future" of Stock Photography

"The Future" of Stock PhotographyTaylor Davidson CEPIC New Media Conference, June 9, 2010, Dublin, Ireland. With Ellen Boughn, Cathy Yeulet, Shannon Fagan and Dittmar Frohmann.

Moments from New Orleans

Moments from New OrleansTaylor Davidson Moments from New Orleans. Audio by Miki Johnson (http://mikijohnson.com) and images by Taylor Davidson (http://www.taylordavidson.com)

Creating Context for your Content

Creating Context for your ContentTaylor Davidson Introductory remarks for Photoshelter's Austin Photo Seminar, "Thriving in Uncertain Photographic Times"

Austin, Texas, March 13, 2010

Event details at http://bit.ly/PSaustin

How to use Twitter to market your photography

How to use Twitter to market your photographyTaylor Davidson Part of the Twitter Revolution panel at PDN PhotoPlus Expo, NYC, October 22, 2009, with @picseshu @jimgoldstein @photojack @newmediaphoto and me (@tdavidson)

Long Way Home

Long Way HomeTaylor Davidson The document describes Taylor Davidson's travels across North America in 2007, visiting numerous national parks and places across the United States, Canada, and Baja California. It lists the locations visited in each state and province along the route, including national parks, cities, and recreational areas in Iowa, South Dakota, Colorado, Utah, California, Oregon, Washington, British Columbia, Alberta, Nevada, and Baja California. The document also provides Taylor Davidson's contact information and website.

How To Fail: 25 Secrets Learned through Failure

How To Fail: 25 Secrets Learned through FailureTaylor Davidson 25 Secrets Learned through Failure, by Taylor Davidson at Unstructured Ventures.

Visit the post on unstructuredventures.com/uv (short link to post: http://tinyurl.com/howtofail ) to add to the discussion, share your lessons learned from failure, and view more.

Ad

Recently uploaded (20)

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - AWS

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - AWSContinuity and Resilience The 14th Middle East Business and IT Resilience Summit

Abu Dhabi, UAE

Date: 7th & 8th May 2025

AWS

Why Startups Should Hire Fractionals - GrowthExpertz

Why Startups Should Hire Fractionals - GrowthExpertzGrowthExpertz Startups are increasingly turning to fractional executives to scale smarter and faster. This deck highlights key data points showing why, from saving over $100K a year on salaries to achieving 50% growth and faster operational impact. If you're a founder looking to grow without the overhead of a full-time hire, this is worth a look. Reach out at marketing@growthexpertz.com or visit growthexpertz.com to learn more.

Joseph Lamar Simmons: Guiding Economic Vision for a Better 2025

Joseph Lamar Simmons: Guiding Economic Vision for a Better 2025Joseph Lamar Simmons Joseph Lamar Simmons shares his vision for a better, more inclusive economic landscape in 2025. Focusing on technology, sustainability, and education, Simmons outlines how nations can drive economic progress while ensuring social equity. His approach combines global collaboration with targeted policy reforms to foster a balanced and thriving economy. With these strategies, he envisions a future where economic growth benefits all and creates lasting opportunities for future generations.

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Zhanar Tuke...

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Zhanar Tuke...Continuity and Resilience The 14th Middle East Business and IT Resilience Summit

Abu Dhabi, UAE

Date: 7th & 8th May 2025 Zhanar Tukeyeva -Foresight-Driven Resilience-Evolving BCM as a National Imperative_choladeck

Unlock Your Potential with Innovative Meta Ads Strategies

Unlock Your Potential with Innovative Meta Ads Strategiesgkeyinfosolution Discover how cutting-edge Meta Ads strategies can elevate your brand visibility, drive targeted traffic, and maximize ROI. This guide explores innovative approaches to Facebook and Instagram advertising, helping you unlock your business's full potential in the digital landscape.

Vannin Healthcare Greencube Electronic Health Record -Modules and Features.pdf

Vannin Healthcare Greencube Electronic Health Record -Modules and Features.pdfovanveen Enterprise Electronic Health Record software Greencube modules and features made by Vannin Healthcare.

Best Places Buy Verified Cash App Accounts- Reviewed (pdf).pdf

Best Places Buy Verified Cash App Accounts- Reviewed (pdf).pdfCashapp Profile Get verified Cash App accounts quickly! We provide 100% authentic, phone-verified Gmail accounts for both the USA and Europe. Secure, reliable, and ready for immediate use

Vision Document and Business Plan of RVNL

Vision Document and Business Plan of RVNLRajesh Prasad A detailed Vision Document and Business Plan of RVNL was got made by the then Director Operations RVNL Mr Rajesh Prasad.

Very good document made with a lot of thought....

2025 May - Prospect & Qualify Leads for B2B in Hubspot - Demand Gen HUG.pptx

2025 May - Prospect & Qualify Leads for B2B in Hubspot - Demand Gen HUG.pptxmjenkins13 In this event we'll cover best practices for identifying high-intent prospects, leveraging HubSpot’s automation tools, ways to boost conversion rates and sales efficiency, and aligning marketing and sales for seamless lead handoff.

Who Should Attend?

👤 Demand Gen & Growth Marketers

👤 Sales & Revenue Operations Professionals

👤 HubSpot Admins & Marketing Ops Experts

👤 B2B Sales & Marketing Leaders

Outline:

Prospecting Leads for B2B in Hubspot

- Building targeted lead lists with HubSpot CRM & Sales Hub

- Using HubSpot Prospecting Workspace & LinkedIn Sales Navigator

Qualifying Leads in Hubspot

- Designing an effective lead scoring model in HubSpot

- Using HubSpot Lead Agent & workflows for automated qualification

Platform Walkthrough & Q/A

Solving Disintermediation in Ride-Hailing

Solving Disintermediation in Ride-Hailingxnayankumar An in-depth analysis of how Ola can combat revenue leakage through product design strategies that discourage off-platform transactions between drivers and riders.

Allan Kinsella: A Life of Accomplishment, Service, Resiliency.

Allan Kinsella: A Life of Accomplishment, Service, Resiliency.Allan Kinsella Allan Kinsella is a New Zealand leader in military, public service, and education. His life reflects resilience, integrity, and national dedication.

for more info. Visit: https://www.slideshare.net/slideshow/allan-kinsella-biography-director-assurance-ministry-for-primary-industries/276260716

1911 Gold Corporate Presentation May 2025.pdf

1911 Gold Corporate Presentation May 2025.pdfShaun Heinrichs 1911 Gold Corporation is located in the heart of the world-class Rice Lake gold district within the West Uchi greenstone belt. The Company holds a dominant land position with over 61,647 Hectares, an operating milling facility, an underground mine with one million ounces in mineral resources, and significant upside surface exploration potential.

Mastering Fact-Oriented Modeling with Natural Language: The Future of Busines...

Mastering Fact-Oriented Modeling with Natural Language: The Future of Busines...Marco Wobben Mastering Fact-Oriented Modeling with Natural Language: The Future of Business Analysis

In the evolving landscape of business analysis, capturing and communicating complex business knowledge in a clear and precise manner is paramount. This session will delve into the principles of fact-oriented modeling and the power of natural language to create effective business models. We'll explore how these techniques can transform your approach to business analysis and bridge the gap between business stakeholders and technical teams.

A (older) recorded demo may be viewed here:

https://www.casetalk.com/articles/videos/360-15-minute-introduction-video

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Sunil Mehta

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Sunil MehtaContinuity and Resilience The 14th Middle East Business and IT Resilience Summit

Abu Dhabi, UAE

Date: 7th & 8th May 2025

Sunil Mehta

NewBase 08 May 2025 Energy News issue - 1786 by Khaled Al Awadi_compressed.pdf

NewBase 08 May 2025 Energy News issue - 1786 by Khaled Al Awadi_compressed.pdfKhaled Al Awadi Greetings,

It is our pleasure to share with you our latest energy news from

NewBase 08 May 2025 Energy News issue - 1786 by Khaled Al Awadi

Regards

Founder & Senior Editor - NewBase Energy

Khaled M Al Awadi, Energy Consultant

MS & BS Mechanical Engineering (HON), USAGreetings,

It is our pleasure to share with you our latest energy news from

NewBase 08 May 2025 Energy News issue - 1786 by Khaled Al Awadi

Regards

Founder & Senior Editor - NewBase Energy

Khaled M Al Awadi, Energy Consultant

MS & BS Mechanical Engineering (HON), USAGreetings,

It is our pleasure to share with you our latest energy news from

NewBase 08 May 2025 Energy News issue - 1786 by Khaled Al Awadi

Regards

Founder & Senior Editor - NewBase Energy

Khaled M Al Awadi, Energy Consultant

MS & BS Mechanical Engineering (HON), USAGreetings,

It is our pleasure to share with you our latest energy news from

NewBase 08 May 2025 Energy News issue - 1786 by Khaled Al Awadi

Regards

Founder & Senior Editor - NewBase Energy

Khaled M Al Awadi, Energy Consultant

MS & BS Mechanical Engineering (HON), USA

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Dr.Carlotta...

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Dr.Carlotta...Continuity and Resilience The 14th Middle East Business and IT Resilience Summit

Abu Dhabi, UAE

Date: 7th & 8th May 2025 - Dr.Carlotta -20250507

Price Bailey Valuation Quarterly Webinar May 2025pdf

Price Bailey Valuation Quarterly Webinar May 2025pdfFelixPerez547899 Our pre-recorded webinar 'Company Valuation: The data and stories emerging from the last 3 months of UK valuations' is now available to watch on demand. Alongside the webinar, we also discuss international tariffs and their impact on business models in more detail.

Understanding the quarterly trends of valuation multiples across the market is vital when making any strategic decision for the long-term future of your business, whether planning a future sale, M&A, identifying growth opportunities to maximise valuation or even for tax reporting purposes.

With substantial experience valuing SME businesses in a variety of sectors, the Strategic Corporate Finance team at Price Bailey provide an in-depth quarterly valuation webinar using the very latest market data, in partnership with MarkToMarket, to analyse UK M&A transaction multiples, evaluate interesting trends across various sectors and review the sentiment towards valuation multiples. This session provides an update as to the latest valuation data in the UK.

Simon, Chand and Eleanor also sit down to discuss the recent updates to international tariffs and how from their experience, they are seeing businesses adapt their business models in relation to these changes.

China Visa Update: New Interview Rule at Delhi Embassy | BTW Visa Services

China Visa Update: New Interview Rule at Delhi Embassy | BTW Visa Servicessiddheshwaryadav696 The Embassy of China in New Delhi now requires personal interviews for visa applicants with document discrepancies. Learn how BTW Visa Services can assist with document checks, interview prep, and smooth visa approval.

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Zhanar Tuke...

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Zhanar Tuke...Continuity and Resilience

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Sunil Mehta

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Sunil MehtaContinuity and Resilience

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Dr.Carlotta...

The Business Conference and IT Resilience Summit Abu Dhabi, UAE - Dr.Carlotta...Continuity and Resilience

Employee Equity 101

- 1. @tdavidson Employees + Equity Crash Course @tdavidson taylordavidson.com

- 4. @tdavidson How do startups raise money?

- 5. @tdavidson Startups raise venture capital by selling part of the company.

- 6. @tdavidson “Raise $1 MM at $5 MM post-money valuation”

- 7. @tdavidson Expect to sell 10-30% in each round of fundraising * * roughly

- 8. @tdavidson Seed, A, B, C, D +

- 9. @tdavidson Each round creates it’s own class of shares

- 10. @tdavidson Founders and Employees own Common, Investors buy Preferred

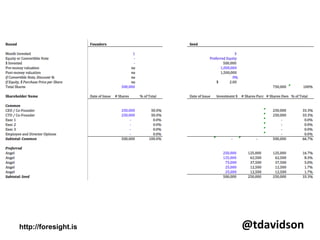

- 11. @tdavidson Capitalization Tables = who owns what

- 14. @tdavidson Option Pools 10-20% of shares

- 16. @tdavidson Options 101 - The right to buy stocks at a predetermined price, or strike price - Strike price set at fair market value - Have to be exercised

- 17. @tdavidson Align risk and reward Reward long-term value creation and thinking Encourage employees to think about holistic success http://firstround.com/article/the-right-way-to-grant- equity-to-your-employees

- 20. @tdavidson If i is the average outcome for the company with the addition of some new person, then they're worth n such that i = 1/(1 - n). Which means n = (i - 1)/i. http://paulgraham.com/equity.html

- 21. @tdavidson For example, suppose you're just two founders and you want to hire an additional hacker who's so good you feel he'll increase the average outcome of the whole company by 20%. n = (1.2 - 1)/1.2 = .167. So you'll break even if you trade 16.7% of the company for him. http://paulgraham.com/equity.html

- 22. @tdavidson Save 20% for employees - Sam Altman, Y Combinator http://blog.samaltman.com/employee-equity

- 23. @tdavidson “As an extremely rough stab at actual numbers, I think a company ought to be giving at least 10% in total to the first 10 employees, 5% to the next 20, and 5% to the next 50. In practice, the optimal numbers may be much higher.” - Sam Altman, Y Combinator http://blog.samaltman.com/employee-equity

- 24. @tdavidson Why?

- 25. @tdavidson CEO: 5-10% C-Level Exec: 1-3% VP, Director: 0.5-2% Manager: 0.25-1.00% Board Directors: 0.5% - Rob Grossman http://rob.by/2013/negotiating-your-startup-job-offer/

- 26. @tdavidson “The only thing that matters in terms of your equity when you join a startup is what percent of the company they are giving you. If management tells you the number of shares and not the total shares outstanding so you can’t compute the percent you own – don’t join the company! They are dishonest and are tricking you and will trick you again many times.” – Chris Dixon http://cdixon.org/2009/08/28/the-one-number-you- should-know-about-your-equity-grant/

- 28. @tdavidson Options are part of a total compensation plan (salary, benefits, options)

- 30. @tdavidson “Your offer is only as good as your negotiation”

- 32. @tdavidson Four year cliff 25% after 1 year Monthly / Quarterly after

- 33. @tdavidson Back weighted 10% after 1 year 20% after 2 years 30% after 3 years 40% after 4 years

- 34. @tdavidson > 4 years Longer vesting should bring larger overall grants

- 35. @tdavidson Refresher / Evergreen New grants during the 4 years http://firstround.com/article/the-right-way-to-grant- equity-to-your-employees

- 36. @tdavidson Technical considerations https://blog.wealthfront.com/stock-options-package- valuation/

- 37. @tdavidson Reporting % on fully diluted shares? https://blog.wealthfront.com/stock-options-package- valuation/

- 38. @tdavidson What happens to vested shares if leave before fully vested https://blog.wealthfront.com/stock-options-package- valuation/

- 39. @tdavidson Early vesting on acquisition https://blog.wealthfront.com/stock-options-package- valuation/

- 40. @tdavidson How are options priced? https://blog.wealthfront.com/stock-options-package- valuation/

- 41. @tdavidson Early exercise of options? https://blog.wealthfront.com/stock-options-package- valuation/

- 42. @tdavidson When was last 409a appraisal? https://blog.wealthfront.com/stock-options-package- valuation/

- 43. @tdavidson What was last funding valuation? https://blog.wealthfront.com/stock-options-package- valuation/

- 44. @tdavidson When is next funding round? https://blog.wealthfront.com/stock-options-package- valuation/

- 45. @tdavidson How to evaluate a startup employer

- 46. @tdavidson Which is better? a) .01% as employee #100 b) 5% as employee #3

- 47. @tdavidson - Do I trust this team? - Do I believe the product will succeed? - Is this the right company? - How much has company raised and on what terms? - How much runway the company has and when they’ll need to raise again? - What is my percentage ownership? - What is the market rate salary and equity comp? - Is there an exit strategy? - What is the estimated valuation at exit? - How long is my vesting schedule? - What are the tax implications?

- 48. @tdavidson You’ve been hired: now what?

- 49. @tdavidson New funding rounds = Dilution

- 50. @tdavidson Dilution? Issue more shares, own smaller % But (hopefully) at larger price per share

- 51. @tdavidson Acquisition or IPO

- 52. @tdavidson All exits not created equal http://rob.by/2013/negotiating-your-startup-job-offer/

- 53. @tdavidson Consider: Preferred / Common Liquidation Preference Valuations

- 54. @tdavidson Raised $18 MM Sold for $20 MM $2 MM to distribute? http://rob.by/2013/negotiating-your-startup-job-offer/

- 55. @tdavidson Details matter Taxes matter Timing matters Legal matters

- 57. @tdavidson Buffer: Open Equity http://open.bufferapp.com/buffer-open-equity-formula/

- 58. @tdavidson Case study: Buffer http://open.bufferapp.com/buffer-open-equity-formula/

- 59. @tdavidson Case study: Buffer http://open.bufferapp.com/buffer-open-equity-formula/

- 60. @tdavidson Additional Resources • AngelList: http://angel.co/jobs • CrunchBase: http://crunchbase.com • Visualization of dilution: http://visual.ly/visualizing-dilution • Fed Wilson’s Cap Table Template: http://avc.com/2011/09/mba-mondays-cap-tables/ • Mark Suster Cap Table and Valuation: http://www.bothsidesofthetable.com/2010/07/22/want-to-know-how-vcs-calculate- valuation-differently-from-founders/ • Anonymous Startup Salaries: http://www.ackwire.com/ • Wealthfront: https://www.wealthfront.com/tools/startup-salary-equity-compensation • Buffer: http://open.bufferapp.com/buffer-open-equity-formula/ • Salary Negotiation: Make More Money, Be More Valued by Patrick McKenzie: http://www.kalzumeus.com/2012/01/23/salary-negotiation/ • Best practices on financial modeling: http://foresight.is/best-practices • An Introduction To Stock & Options by David Weekly: • Book: http://www.scribd.com/doc/55945011/An-Introduction-to-Stock-Options-for-the-Tech- Entrepreneur-or-Startup-Employee • Video: http://blog.dweek.ly/introduction-to-stock-options-startup-founder-entrepreneur- employee/